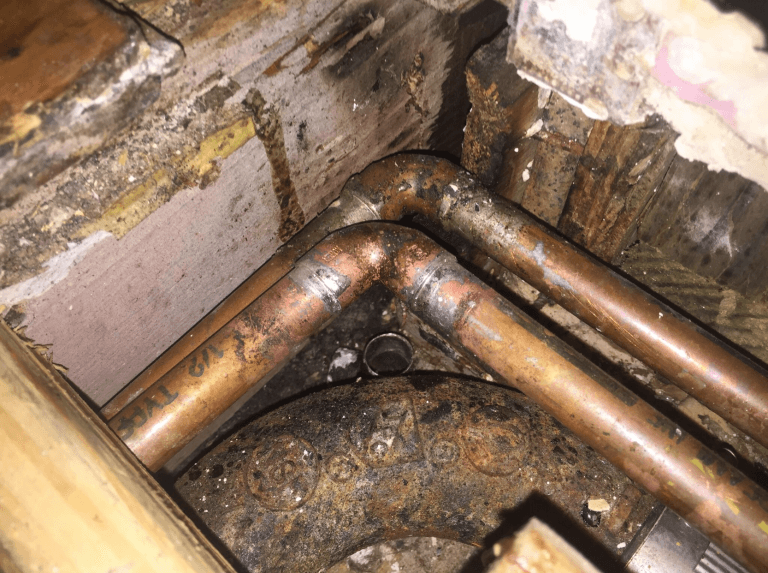

Flatbush, Brooklyn – Three story commercial building experienced property damage when the sprinkler system pipes froze and burst. In addition, the 11,200 sq. ft. building’s baseboard heating plumbing lines froze and burst causing water damage throughout three floors plus the basement.

The insurance company was looking to deny claim and sent a reservation of rights letter which outlined exclusions and endorsements; including the protective safeguard endorsement. P-9. Considering the insurance company’s position, our team of industry experts quickly responded to the insurance company’s reservation of rights letter. An excerpt from our client’s property damage insurance attorney letter stated:

The protective safeguards required by the policy were specifically tailored to prevent a loss caused by fire or burglary. This loss was caused by water flooding from frozen sprinkler pipes, and as such there can be no breach of the warranty provision of the policy.

Here, the Protective Safeguards endorsement of the policy, at subsection (2)(a), define the subject Automatic Sprinkler System required to be maintained as “[A]ny automatic fire protective or extinguishing system.” (emphasis added). The protective systems at P-9 has a description that includes automatic burglar alarm, protecting the entire building(emphasis added). A plain reading of the Protective Safeguards in the policy establishes they are designed to prevent loss caused by fire or burglary.

New York Insurance Law §3106, entitled “Warranty defined; effect of breach, at subsection (b), states in pertinent part:

“(b) A breach of warranty shall not avoid an insurance contract or defeat recovery thereunder unless such breach materially increases the risk of loss, damage or injury within the coverage of the contract. If the insurance contract specified two or more distinct kinds of loss, damage or injury which are within its coverage, a breach of warranty shall not avoid such contract or defeat recovery thereunder with respect to any kind or kinds of loss, damage or injury other than the kind or kinds to which such warranty relates and the risk of which is materially increased by the breach of such warranty.”

In Anghel v. Utica Mutual Insurance Co., 127 A.D.3d 897, 7 N.Y.S.3d 390 (2d Dept. 2015), in a case on all fours with this claim decided in this judicial department, the insured suffered a loss caused by flood from a frozen sprinkler pipe. The Second Department specifically held the policy protective safeguard endorsement was not applicable as it related only to fire loss and thus provided no basis for denial of the claim. It further found there (as here), that the protective safeguard endorsement qualified as a warranty defined by New York Insurance Law §3106, and, as the warranty related only to fire loss, any breach thereof could not defeat recovery on the claim for flood loss.

Upon receipt of the detailed response to the insurance company’s reservation of rights letter, and detailed claim submission for covered water damages, the insurance company quickly reversed their decision and then demanded a building appraisal to finalize any disputes. The original offer was a zero offer, but with fierce advocacy United settled the claim at $570, 974.02.

United Public Adjusters & Appraisers, Inc. ONLY Represents the Policyholder, NOT the insurance company! Don’t let the insurance company intimidate you out of a fair settlement. Please call our firm to discuss your Property Damage Claim and see if we can be a resource as it’s never too late for us to get involved!

We have offices in California, NYC and Long Island and can be reached at 718-641-5677 (LOSS) or 866-418-9121 (LOSS) or help@unitedpublicadjusters.com

MY FREE CONSULTATION

"*" indicates required fields