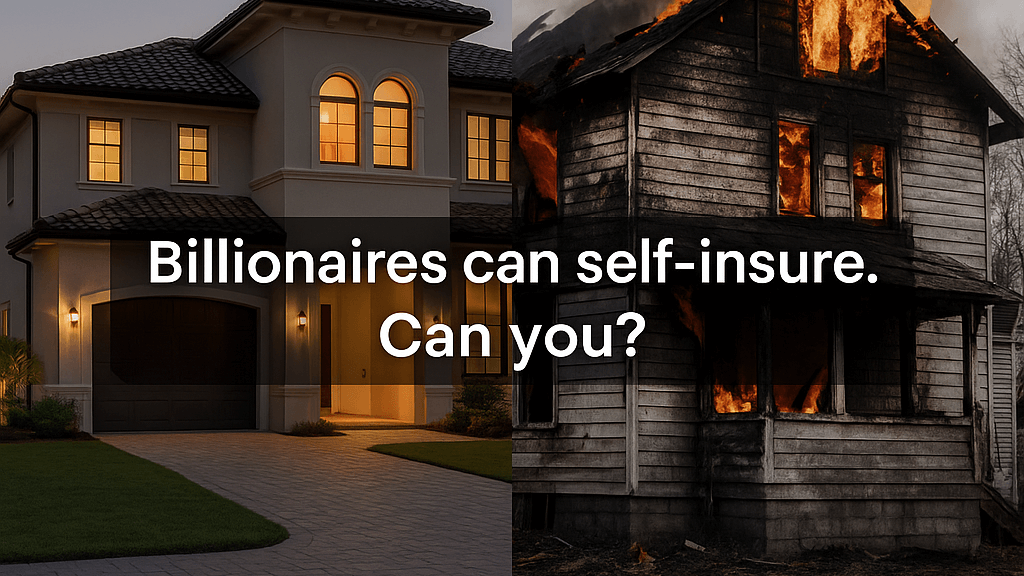

When billionaire Charlie Munger revealed that he dropped fire insurance on his homes because he could “self-insure,” it wasn’t reckless, for him, it was practical. For someone worth billions, losing a house wasn’t a financial crisis. What Munger really wanted to avoid was the hassle of insurance companies, adjusters, and claims.

But what about the rest of us?

Why Everyday Homeowners Can’t Self-Insure

For most families, a home is the single largest investment of your lives. A catastrophic fire, flood, or storm isn’t just inconvenient, it’s truly devastating.

- Self-insuring is impossible for most homeowners. Rebuilding from scratch or replacing everything inside could cost hundreds of thousands, even millions of dollars.

- Insurance is essential. Without it, many families could never recover from a major loss.

But here’s the hard truth: just having insurance doesn’t mean you’re truly protected. And it is exactly when you need the professional services of licensed public adjusters for home insurance claims to stand up for your rights.

The Real Lesson in Munger’s Comment

Munger admitted what he was really escaping wasn’t the loss itself, but the claims process: slow, complicated, and often adversarial.

This is what everyday policyholders discover too late:

- Insurance adjusters, engineers, and consultants work for the carrier, not for you.

- Reports and estimates often downplay or omit damage.

- The burden of proof falls on you, the homeowner, when you’re already overwhelmed.

In other words, the “hassle” Munger could afford to skip is the same maze most families get trapped in.

Why Public Adjusters Exist

This is where United Public Adjusters & Appraisers, as your licensed Public Adjuster for insurance claims come in.

We represent only you as the policyholder — never your insurance company. Our role is to level the playing field by:

- Reviewing carrier reports for omissions and inaccuracies.

- Building a complete, evidence-backed claim that reflects the true scope of damage.

- Negotiating directly with insurers to secure the settlement you’re owed.

Where Munger’s shield was wealth, yours can be having the right advocate in your corner. That’s when United Public Adjusters & Appraisers, as public adjusters for home insurance claims, can be your best ally.

The Takeaway

Munger’s advice was simple: “Insure against what you can’t afford to lose.” For most homeowners, insurance isn’t optional, it’s survival.

But his second point matters just as much: the claims process is a burden best avoided.

Unless you have a billionaire’s bank account, the smartest way to avoid that burden is to hire someone who knows the system, knows the tactics, and knows how to fight for your recovery.

That’s exactly what we do as public adjusters for insurance claims. And it’s why homeowners who work with Public Adjusters consistently recover more and recover faster.

By Philip L. Maltaghati

Licensed Public Insurance Adjuster

United Public Adjusters & Appraisers, Inc.

CA, CO, CT, DC, DE, FL, GA, LA, MA, MD, ME, MN, MO, NC, NH, NJ, NV, NY, OH, OK, PA, RI, SC, TN, TX, UT, VA, VT, Puerto Rico and US Virgin Islands

Florida License #W364451

California Personal License #2M66461

California Business License: #2M53073

California Office: 5161 Lankershim Blvd 2nd Floor North Hollywood, CA 91601

******************************************************************************

CITATIONS

This blog summarizes a UPA posting on LinkedIn which was inspired by reporting from Yahoo Finance on Charlie Munger’s remarks about self-insuring.

MY FREE CONSULTATION

"*" indicates required fields